California Revocable TOD Deeds

If you live in California and are thinking about a transfer on death deed, the place to start is this video from the Sacramento Law Library, which does an excellent job of explaining California's transfer on death law, which been in effect since January 2016, and revised in 2022.*

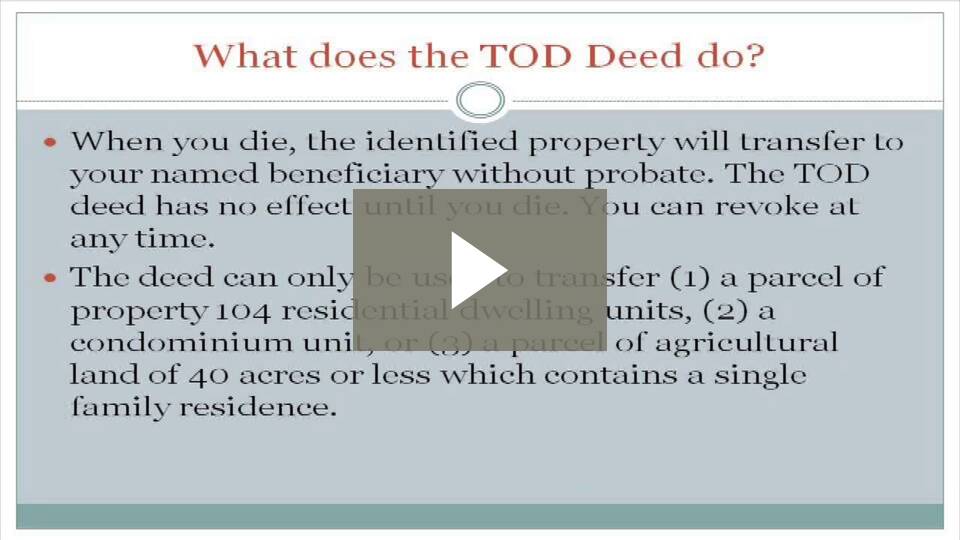

Sacramento Law Library Video:

Part 1 Intro and TOD Deed Overview

Tramsfer on death deeds can be an ideal tool for California is looking for a simple way to transfer real estate.

Here's a complete toolkit for using TOD Deeds in Calfornia offered by the Sacramento Law Library.

(* As of Jan. 1, 2022, California TOD deeds must now be signed by two witnesses, and after the donor dies, the beneficiaries must notify all heirs and file multiple papers. Beneficiaries who are transferring real estate into their name should use their guide Transferring Title to Beneficiaries after a Transfer on Death Deed Takes Effect.)

Bank Accounts

Between TOD financial accounts and TOD deeds for real estate (in the states that allow them), many people leave little or nothing through probate or a will.

TOD Financial Accounts

A payable-on-death account is a bank or brokerage account with a designated beneficiary. Sometimes these are also called "Totten Trusts" or transfer-on-death accounts.

Whatever they're called, at the death of the account owner, the assets in the account are distributed to the person or people designated as account beneficiaries.

Usually, all that's required at the death of the account owner, is for the designated beneficiary to fill out a claim form and to supply a copy of the death certificate.

That's it.

If you're not sure whether or not an account had a designated beneficiary, you'll need to check with the bank or brokerage company and check on the account's registration.

For example, if Nila opened a checking account and then designated her brother, Jack, as the payable-on-death beneficiary, upon Nila's death, Jack will receive the account's assets.