CONTENTS:

Do I Qualify for Chapter 7 Lien Avoidance?

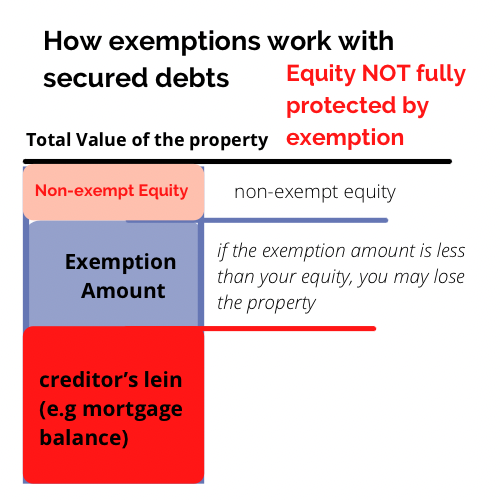

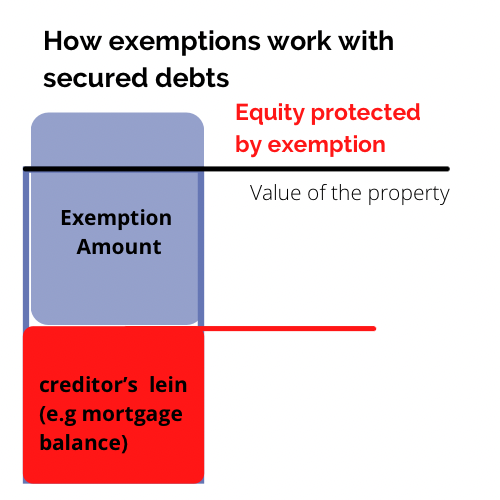

If there is a judicial lien on your property (as a result of a court judgment against you), you may have the right to remove it, if it "impairs" an exemption on the property.

That is, if you have some equity in your property that is protected by an exemption, you can get any judicial liens on it removed by the bankruptcy court as another element of the "fresh start" that bankruptcy is designed to provide.

This "impairment" requirement is a catch 22, though. You might think that if your property is completely under water, you should be able to strip off judgement liens. But that is not the case. Because if the property is completely under water, due to other secured claims, (such as a mortgage or secured auto loan), then there is no equity to be protected by an exemption, and therefore there is no exemption to be "impaired", because you have no equity.

So, to be eligible for this kind of lien avoidance, you must have at least some equity in the property, and that equity must be protected by an exemption.

How to Request Lien Avoidance

Having this kind of lien removed ("avoided") is an extra step you have to specifically request. It doesn't just happen automatically, and most lawyers charge extra for it.

And some lawyers forget to check if any liens can be removed from your property, while your bankruptcy case is open. Be sure to check if there are judicial liens on your property, be sure to determine which ones can be eliminated, or reduced, through a "lien avoidance" procedure.

Some liens cannot be removed however, including most tax liens and any judicial lien that secures a domestic support obligation. 11 U.S.C.A. § 522(f)(1)(A).

For more information on lien avoidance, when it's available and step by step procedural guidance how to do it, see Chapter 5 of How to File for Chapter 7 Bankruptcy, 22nd Edition, by Albin Renauer & Cara O'Neil.

Note that some judicial district web sites have links for those who provide free legal assistance to debtors who need representation in a lien avoidance proceeding.

"Lien Stripping" vs "Lien Avoidance"

Are Lien Stripping and Lien Avoidance the same thing?

No, "lien stripping" and "lien avoidance" are not the same thing, although they both involve removing liens from property in bankruptcy.

Lien stripping is the process of removing a wholly unsecured lien from a debtor's property in Chapter 13 bankruptcy. This means that the value of the property securing the lien is less than the amount of the lien. In this process, the lien is treated (in whole, or in part, depending on the value of the property) as an unsecured debt, which means that it is paid the same percentage as other unsecured debts, such as credit card debt or medical bills.

Lien avoidance, on the other hand, is the process of removing a lien from property in Chapter 7 or Chapter 13 bankruptcy when the lien impairs a debtor's exemptions and the value of the property subject to the lien is less than the amount of the lien. This process is used when the debtor wants to keep the property that is subject to the lien and needs to remove the lien in order to do so. In lien avoidance, the lien is treated as a secured debt, but it is removed from the property and treated as unsecured debt in the bankruptcy process.

In summary, while both lien stripping and lien avoidance involve removing liens from property in bankruptcy, they are different processes that are used in different situations and under different bankruptcy chapters.

"Avoiding Liens": What it is. How to Do It

Liens can be "avoided" in bankruptcy when

- they impair a debtor's exemptions, and

- the value of the property subject to the lien is less than the amount of the lien.

This process is known as lien avoidance, and it allows the debtor to remove the lien from the property and treat it as unsecured debt in the bankruptcy process.

Here are the step-by-step processes for lien avoidance in bankruptcy:

-

Determine eligibility: To be eligible for lien avoidance, the debtor must file for bankruptcy under either Chapter 7 or Chapter 13, and:

-

the lien must impair the debtor's exemptions.

-

In addition, the value of the property subject to the lien must be less than the amount of the lien.

-

File a motion: Once eligibility is determined, the debtor or their attorney must file a motion with the bankruptcy court requesting that the court avoid the lien from the debtor's property.

-

Serve notice: The debtor or their attorney must also serve notice of the motion on the holder of the lien, as well as any other interested parties, such as other creditors or lienholders.

-

Hold a hearing: The court will hold a hearing on the motion, at which the debtor or their attorney will present evidence that the lien impairs their exemptions and the value of the property subject to the lien is less than the amount of the lien. The holder of the lien may also present evidence and arguments in opposition to the motion.

-

Obtain a court order: If the court agrees that the lien should be avoided, it will issue an order to that effect. The order will provide that the lien is no longer a valid claim against the debtor's property, and that the holder of the lien must release it.

-

Comply with the order: The holder of the lien must comply with the court's order, which may include releasing the lien and executing any necessary documents to transfer ownership of the property to the debtor.

Statutory citations from U.S. Bankruptcy Code.

- Chapter 7 Cases: Section 522(f) (liens that impair an exemption) provides the authority for lien avoidance in Chapter 7 bankruptcy cases,

- Chapter 13 Cases: Section 506(d) (property worth less than it's value) provides the authority for lien avoidance in Chapter 13 bankruptcy cases.

These sections allow debtors to avoid liens that impair their exemptions and are secured by property that is worth less than the amount of the lien.

In addition, some state laws may provide additional authority for lien avoidance in bankruptcy.

"Stripping Liens": What it is. How to Do It

Stripping liens in bankruptcy involves:

removing a lien that encumbers a debtor's property, and treating the lien as unsecured debt in the bankruptcy process.

This process is available in Chapter 13 bankruptcy, but not in Chapter 7 bankruptcy.

Here are the step-by-step processes for stripping liens in bankruptcy:

-

Determine eligibility: To be eligible to strip a lien in bankruptcy, the debtor must file for bankruptcy under Chapter 13, and

-

the lien must be entirely unsecured, or

-

If the lien is partially secured, the debtor may still be able to strip it, but only to the extent that the lien exceeds the value of the property securing it.

-

File a motion: Once eligibility is determined, the debtor or their attorney must file a motion with the bankruptcy court requesting that the court strip the lien from the debtor's property.

-

Serve notice: The debtor or their attorney must also serve notice of the motion on the holder of the lien, as well as any other interested parties, such as other creditors or lienholders.

-

Hold a hearing: The court will hold a hearing on the motion, at which the debtor or their attorney will present evidence that the lien is unsecured and should be stripped. The holder of the lien may also present evidence and arguments in opposition to the motion.

-

Obtain a court order: If the court agrees that the lien should be stripped, it will issue an order to that effect. The order will provide that the lien is no longer a valid claim against the debtor's property, and that the holder of the lien must release it.

-

Comply with the order: The holder of the lien must comply with the court's order, which may include releasing the lien and executing any necessary documents to transfer ownership of the property to the debtor.

Citations:

The statutory citations for stripping liens in bankruptcy will depend on the jurisdiction where the bankruptcy case is filed, as bankruptcy law is primarily governed by federal law but also incorporates state law.

Federal Law:

The relevant sections of the Bankruptcy Code that allow for lien stripping in Chapter 13 bankruptcy are:

- 11 U.S.C. § 506 and

- 11 U.S.C. § 1322(b)(2).

These sections provide the framework for how secured claims are treated in bankruptcy, and allow the court to modify the rights of a lien-holder to the extent that the lien is unsecured.

The extent to which an asset is under-secured will depend on

- the value of the property

- what other liens are on the property

- what exemption laws apply to any debtor's equity in the property

State & Local Laws regarding:

- Lien priority

- Mortgage rules

- Recording requirements for "perfecting" a lien

Lein FAQs

What does it mean to "perfect" a lien?

To "perfect" a lien means

to take the necessary legal steps to establish a valid and enforceable claim against the property that is subject to the lien.

When a creditor has a secured interest in property, such as a mortgage on a home or a security interest in a car, they must "perfect" their lien in order to have priority over other creditors or parties with an interest in the property.

The process of perfecting a lien varies depending on the type of property and the applicable laws.

Generally, it involves filing a notice or documentation with the appropriate government agency, such as

- a county recorder or

- state agency,

to put others on notice of the creditor's claim to the property.

Example: When a mortgage lender provides a loan to a borrower, they will typically record a mortgage with the county recorder's office to perfect their lien on the borrower's property.

Once a creditor has perfected their lien, they have a legal claim against the property that gives them the right to foreclose or take possession of the property if the debtor defaults on their obligations.

The creditor's lien also provides them with priority over other creditors in the event of the debtor's bankruptcy or other legal proceedings.

In summary, perfecting a lien means taking the necessary steps to establish a valid and enforceable claim against property that is subject to the lien, which gives the creditor the right to enforce their claim and priority over other creditors.

What is "Lien Priority?"

Lien priority refers to the order in which different liens on a property are paid or satisfied in the event of a sale or foreclosure of the property. The priority of liens determines the order in which creditors will be paid out of the proceeds from the sale or foreclosure.

The general rule of lien priority is "first in time, first in right." This means that the first lien recorded or perfected against the property has priority over any liens recorded or perfected later in time.

Example: If a mortgage is recorded on a property in 2010, and a second mortgage is recorded on the same property in 2015, the first mortgage has priority over the second mortgage, and will be paid out of the proceeds from a sale or foreclosure before the second mortgage.

However, there are some exceptions to the "first in time, first in right" rule. For example, some liens are given priority by law, regardless of when they were recorded or perfected.

For instance,

- property tax liens and

- mechanic's liens

are often given priority over other liens.

In addition, some liens can be "subordinated" by agreement. This means that the lienholder agrees to give up their priority position to another lienholder. For example, a second mortgage holder may agree to subordinate their lien to a first mortgage holder, which would give the first mortgage holder priority in the event of a sale or foreclosure.

Lien priority is an important consideration for both creditors and debtors, as it affects the amount and order in which they will be paid in the event of a sale or foreclosure of the property. It is important to understand the rules and exceptions regarding lien priority in order to properly evaluate the value and risk associated with a lien on a property.

What is a "mechanics lien"?

A mechanics lien, also known as a construction lien or a contractor's lien, is a legal claim that can be placed on a property by someone who has provided labor or materials for a construction or renovation project but has not been paid. Mechanics liens are typically used in the construction industry to protect contractors, subcontractors, and suppliers from non-payment for their work or materials.

In general, mechanics liens give the lienholder the right to force the sale of the property to recover the unpaid debt. This means that if a property owner fails to pay a contractor or supplier for work or materials, the contractor or supplier may be able to place a mechanics lien on the property. If the debt remains unpaid, the lienholder can foreclose on the lien and force the sale of the property to recover the amount owed.

Mechanics lien laws vary by state, but in general, a mechanics lien must be filed within a certain time period after the work or materials were provided, and the lienholder must provide notice to the property owner and other parties involved in the project. In addition, the lienholder must usually take legal action within a certain time period to foreclose on the lien and force the sale of the property.

Mechanics liens can be complicated and involve a variety of legal requirements, so it is important for contractors, subcontractors, and suppliers to understand their rights and obligations when it comes to mechanics liens. Property owners also need to be aware of the potential for mechanics liens and should take steps to protect themselves from liens by ensuring that they have clear contracts with their contractors and suppliers, and that they make timely payments for work and materials.

Where Do I Go to Find Out What Liens Are On My Property?

To find out what liens are on your property, you can start by conducting a search of the public records in the county where your property is located. The records are typically maintained by the county clerk, recorder, or assessor's office, and may be available online or in person.

Here are the steps to follow:

-

Identify the county where your property is located.

-

Visit the website of the county clerk, recorder, or assessor's office.

-

Look for a "property records" or "land records" section on the website.

-

Check if the records are available online, and if so, create an account and log in.

-

Use the search function to look up your property by its address or parcel number.

-

Look for any recorded documents that indicate a lien, such as a mortgage, tax lien, or mechanics lien.

If you are unable to find the information online, you may need to visit the county office in person and request a copy of the property records. In some cases, you may also need to pay a fee for copies of the records.

It is important to note that not all liens may be recorded in the public records, so it may be necessary to conduct additional research or seek the advice of a qualified professional, such as a real estate attorney or title company, to determine if there are any additional liens or encumbrances on your property.

What is a Judicial Lien or a Judgement Lien, and are they the same thing?

Yes, a judicial lien and a judgment lien are the same thing. A judicial lien, also known as a judgment lien, is a type of lien that is created by a court order in a lawsuit.

When a court enters a judgment against a debtor in a lawsuit, the judgment becomes a lien on the debtor's property. This means that the creditor has a legal claim on the property and can enforce the lien by seizing the property or obtaining a court order to force a sale of the property to satisfy the debt.

Judgment liens can be created on both real property (such as a house or land) and personal property (such as a car or bank account). In some cases, the judgment lien may have priority over other liens on the property, such as mortgages or other secured debts.

It is important to note that judgment liens can have serious consequences for debtors, as they can make it difficult or impossible to sell or refinance the property. If you are facing a judgment lien, it is important to consult with an attorney to understand your options for resolving the debt and protecting your property.